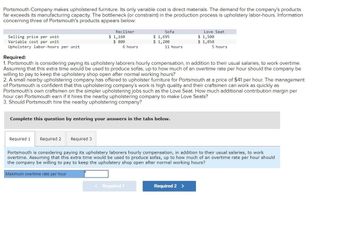

To overcome this challenge, companies ought to use price accounting strategies corresponding to activity-based costing (ABC) or job costing. These strategies allocate costs to particular products based on the actions required to provide them. By utilizing these methods, businesses can extra precisely measure variable costs and calculate variable cost per unit. In conclusion, analyzing the variable cost per unit is essential for companies to make knowledgeable decisions about pricing strategies and revenue margins. By understanding the impression of variable cost per unit on pricing and profit margins, businesses can set prices which are aggressive, but profitable. This is as a result of variable costs are tied to the entire amount of items you produce.

The BEP method divides the total fixed production prices by the price per individual unit less the variable price per unit. Similarly, tracking changes in variable price per unit can indicate potential points in your manufacturing process. A sudden increase may signal inefficiencies or issues that need to be addressed, whereas a lower would possibly reflect profitable cost-saving measures or elevated effectivity. The choice to extend manufacturing should ideally result in a decrease in the variable cost per unit as a end result of economies of scale. You must think about the capacity of your operations and the potential for prices to rise as a result of additional time pay or overuse of resources. It’s calculated by subtracting total prices from total income and then dividing by whole revenue, usually expressed as a proportion.

Adjust For Activity Changes

If the company has no gross sales, the total gross sales fee expense might be $0. Gross Sales of $400,000 will end in complete gross sales commission expense of $20,000. Utilizing the above-given data, we are going to first calculate calculate the entire variable value. Direct labor refers back to the wages paid to employees who can trace their efforts on to the manufacturing of products or companies.

Decide Exercise Stage

Let us perceive why businesses use each absorption and variable costing calculator through the dialogue beneath. Direct materials are the uncooked components or elements that go directly into producing a finished product. Assume of it like constructing a house; the bricks, lumber, and nails are the direct supplies that make up the structure. In manufacturing phrases, these are the primary inputs essential to create a product. For instance, in a bakery, flour, sugar, and eggs can be thought-about direct supplies.

These prices differ with the amount of products or companies produced and sold. Variable prices are necessary for businesses to understand as they directly influence profitability and pricing choices. By closely monitoring and managing variable prices, businesses can make informed choices about production ranges, pricing methods https://www.simple-accounting.org/, and useful resource allocation.

In calculating the ratio, mounted prices, that are the expenses that remain constant no matter variations in production ranges, are excluded. In administration accounting, variable costs are price items whose complete value varies proportionately with some underlying activity stage such as complete units, labor hours, machine hours, etc. In conclusion, variable price per unit is a crucial concept to understand when it comes to managing a enterprise.

- For example, the price of raw materials used to provide widgets is a variable value.

- Variable costs are expenses that change in proportion to the extent of production output.

- In a nutshell, prime costs capture all direct production prices, whereas conversion costs concentrate on the transformation course of from raw materials to finished product.

- On the opposite hand, average price is just the total value divided by the number of items produced.

The company’s web income includes the sum of its returns, allowances, and reductions subtracted from the whole sales. If the production stage will increase, variable prices additionally increase and vice versa. For occasion, if an organization produces more units, it will need more raw supplies, resulting in a rise in variable costs.

By understanding this, you can decide the cost implications of increasing or decreasing your manufacturing levels. So while the break-even level gives you the minimum target to cowl your costs, the profit margin tells you how a lot of your sales flip into revenue. Both are crucial metrics in relation to making strategic business decisions about pricing, production, and progress. These prices that change relying on what number of pastries you make are what we call variable prices. And when we discuss variable cost per unit, we’re taking a look at how much it costs you to make simply a sort of tasty treats. For instance, if a enterprise sells a product with a high variable cost per unit, similar to a luxury automotive, they might want to set the next worth to cover their costs and make a revenue.

If the variable value per unit is excessive, companies might need to set a higher value to guarantee that they cover their prices and make a profit. On the other hand, if the variable price per unit is low, businesses can set a cheaper price and nonetheless make a profit. By utilizing this formula, companies can determine the price per unit of their products, which is crucial for pricing decisions and figuring out profitability.

It represents the whole quantity you’ve spent to produce a certain number of items or companies. This consists of every little thing from the price of uncooked materials to the hire for your corporation premises. By analyzing the variable price per unit, the corporate can identify areas where they can scale back costs and improve profitability.

English

English